Messages sent by the Fed regarding its interest rate lift off and balance sheet run off have conditioned performances since the beginning of the year. The Fed turned hawkish in mid-December, and confirmed its determination to fight inflation during its FOMC meeting in January. As a consequence, real yields have risen sharply and triggered a rotation in equity factors.

The start of this year is all about inflation

Over the past two years, Covid-19 infections have triggered supply-side disruptions and demand-side swings. Both combined to generate a synchronized and historically unprecedented shock to energy and goods – the global inflation pickup is not driven by services. Upside risks to price pressures remain via labour shortage and demand tilted towards goods as long as economies have not fully reopened. Geopolitical tension adds to the extreme unpredictability, bumpiness and volatility around the pandemic cycle.

In the US, the housing component (“Owner-equivalent rent”, which does not exist in the Eurozone) and rents account for 40% of the US CPI basket; considering the 20% increase in home prices last year, US rents look set to sustain upward pressure. In addition, wages and labour costs are very dynamic as the unemployment rate at 3.9% and low participation rate point to a risk of second-round effects on inflation from wages.

Fed chair Powell seems confident about the outlook for growth, implicitly confirming that the Fed is anxious to maintain and extend the expansion. The advanced estimate for the fourth quarter confirmed Jerome Powell’s confidence as GDP grew at a higher-than-expected 6.9% pace to close out 2021, in spite of the omicron spread. If CPI inflation just hit its highest level since 1982, we note that the 5.7% GDP growth rate in 2021 is also the highest level since 1984.

In this context, the risk for the Fed today would be to be perceived as too lax and behind the curve

It therefore wants to show – for example via the level of its median dot at 2.125 in December 2024 – that it is aiming to bring inflation under control. As the economic and employment context supports a tightening, current Fed rhetoric seems logical and coherent today.

Of course, the upcoming data will be key to monitor, as lower economic surprises coupled with higher interest rates could harm stock markets, in particular as the strike of the “Fed Put” is probably far out-of-the-money due to inflation concerns.

Central banks in many emerging countries, but also in Anglo-Saxon countries (e.g. UK, Canada, Australia, New Zealand) and Norway are already embarked in a tightening cycle. But among the major central banks, an easing PBOC and a dovish BoJ and ECB brings global policy divergence for now.

The beginning of a Fed rate hike cycle is usually a very delicate time for equities

We anticipated in our Outlook for 2022 a higher level of volatility and a contagion from bonds to equities and possibly forex afterwards. It always happens faster than expected, this is the case since the end of December 2021.

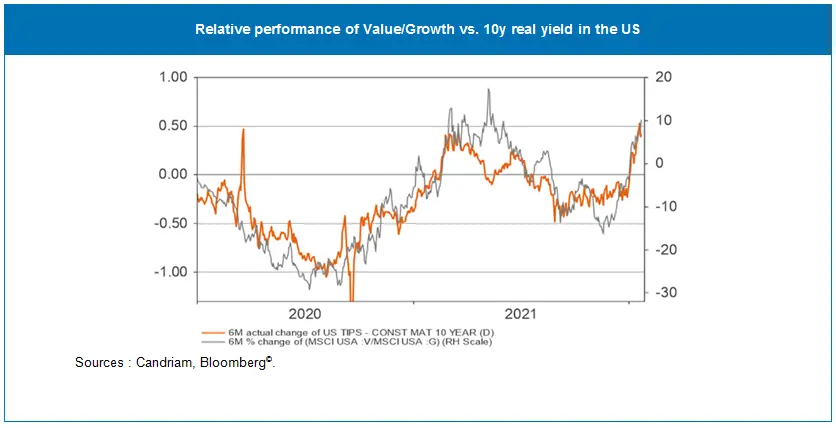

The highest volatility is under the surface, in the rotation between sectors and stocks: what was most owned and expensive is sold, while laggards are now outperforming. This sharp rotation in equity factors is triggered by an increase in real yields.

As shown on the chart below, the impact of real yields on equity factor performances has strengthened since the beginning of the pandemic. In the US, Value / Growth performance is clearly in line with the evolution of real yields due to the valuation sensitivity for discounting future cash flows. We note that the current move in rates seems limited in time and amplitude compared to the six previous rotation episodes of the past quarter of a century (2003, 2005, 2008, 2013, 2016 and 2020). We are just in the second month of a rotation (vs. eight on average) and the movement in nominal rates is still contained compared to average previous major movements (40 bps vs 120 bps). Contrary to the current episode, we note that the performance of the S&P500 during all those periods was positive (between +4% and +20%).

Considering the violence of the style rotation, can we consider that we are close to its end?

We observe an extreme performance gap between some sectors: between energy and technology, there is a 30% performance gap since the beginning of the year for example. Many growth stocks (especially mid-caps) are down 15 to 20% since the beginning of the year. Their valuation by discounted cash flow is clearly becoming more attractive again. So how do we measure the risk of further rotation? Will we come back to the previous trends later?

We are looking for triggers for a change in investor positioning:

- real rates: we should probably experience a stabilization phase but we think there is still room for real rate growth by the end of the year, which represents a headwind for growth stocks. However, part of the way has been made

- corporate earnings growth: this will be the main driver of equity gains in a tightening monetary environment. We had highlighted the relative caution of analysts (+8% expected in 2022 for global equities, which is low compared to expected GDP growth). This means that we normally have a cushion to face some disappointments on margins or sales figures.

- anticipations of monetary tightening : The difficulty is to understand when investors' expectations on the Fed tightening will have reached their maximum and will have gone too far compared to what the Fed wants to or can do. The consequence of this would be a likely unwinding of the current rotation (temporary or not).

Are we at that turning point?

Between now and March (first rate hike expected), the Fed has little reason to be more dovish. Inflation numbers are not going to slow down right away. While tensions with Russia are a risk for energy prices.

We will on the other side continue to closely watch:

- Signs of less inflationary pressure: on the supply side but also on wages.

- and signs of disappointing economic growth (which could come from lower demand).

We believe we will continue to see volatility and rotation between styles. The Fed's tightening of monetary policy provides a new investment framework for the beginning of the year. The post-COVID-19 positioning on growth stocks fuelled by the sharp drop in rates and very expansionary monetary policies had reached extreme levels. On the other hand, we remain attentive to the investment opportunities that growth and quality companies can offer in the medium term. We therefore remain moderately overweight in non-US equities with the most balanced style possible to get through this normalization phase.