Equity markets appear to be resolutely bullish. Nothing seems to have been able to cause the indices to deviate significantly from their upward trend since the start of the year.

Tensions between Iran and the US at the beginning of January triggered a spike in volatility, which rapidly fell back to the lowest levels seen in December. More recently, statements from the World Health Organisation regarding the outbreak of the new coronavirus in China instilled a sense of fear in the markets at the end of January, which has now been almost forgotten however. The US market (S&P 500) has gained more than 4% year to date, reaching an all-time high on Tuesday 11 February 2020. The contrast between the strength of positive momentum among major equity indices and the alarming daily newsflow has rarely been so stark. So, is this optimism or complacency?

Equity investors appear to have firmly decided to be more optimistic. We know that the first quarter will be heavily impacted by the exceptional measures implemented by the Chinese authorities. Regions representing almost 50% of China’s GDP have been concerned by quarantine measures or limitations on the free movement of people, while company and factory closures have been extended beyond the usual holiday period celebrating the Chinese New Year. Certain sectors have been hit particularly hard, with China representing almost 30% of manufacturing production worldwide and more than 20% of energy use, and just over 10% of global consumption.

Consumption and production will therefore “temporarily” be heavily impacted in China and in the country’s close trading partners. In that case, what is the apparent optimism expressed by equity investors based on? To simplify, we could say that equity markets are pricing-in the idea that the negative impact, although heavy, will only be temporary and will be largely offset during the second half of the year. This is possible if the peak of the epidemic comes into view over the next few weeks and the mortality rate does not increase, and as long as contagion outside of China remains highly limited. Under these conditions, business will pick up progressively during the second and third quarters and compensate the downturn recorded at the beginning of the year. Investors believe that a poor first quarter is now a known factor and are focusing on the rest of the year.

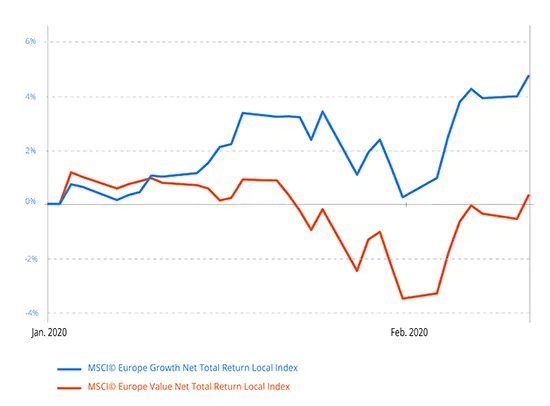

Is this reasonable? At what point do we tip into complacency? Not all financial markets are sending out the same signals however. The oil price has fallen by 25% since the start of January, while industrial metals prices are also down 10% and US bond yields have returned almost to the levels recorded during the summer when investors feared a recession in 2020. Investors are also choosing selectively, with growth and quality stocks outperforming cyclicals and value stocks. We will only find out later whether equity markets were optimistic or complacent.

Equity markets are clearly reflecting greater optimism than commodities or interest rates. We have opted since the end of January to adopt a slightly more cautious approach, pending clearer visibility on the spread and the impact of the epidemic.