The progressive reopening of the economies around the world, coupled with a lot of media coverage on the relative virus-spread containment in Europe and Asia, along with the progress made in vaccine development, is keeping the market alive. We seem nonetheless still to be some way from returning to our normal daily routines but, despite that, markets remain strong and buoyant. Caution is required.

The progressive reopening of the economies around the world, coupled with a lot of media coverage on the relative virus-spread containment in Europe and Asia, along with the progress made in vaccine development, is keeping the market alive. We seem nonetheless still to be some way from returning to our normal daily routines but, despite that, markets remain strong and buoyant. Caution is required.

Equity markets had a strong month of June, with riskier assets outperforming. Turkey, Brazil, South Africa and India were among the top performers, with high single-digit returns. Developed Market equities were in positive territory, with European equities outperforming broad diversified US equity indices. The Nasdaq continues to be a positive outlier, due to accelerating digital-economy penetration. At sector level, cyclicals benefited from a market rotation into financials and industrials.

Developed Market government yields remain stable and stuck at the bottom. The risk-on environment has mainly benefited spread compression in Emerging Markets and the riskier issues within Europe.

The HFRX Global Hedge Fund EUR gained +1.44% over the month.

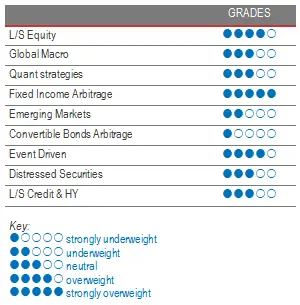

Long short equity

Overall, June was a good month for Long Short Equity funds, with performances driven mainly by long positions and exposures to technology stocks and thematics. From late May going into June, the very significant rotation from Growth / Momentum into Value Investment-driven stocks hurt hedge fund performance, since strategies are more long Growth- and short Value factor-orientated. The factor rotation slowed down from mid-month onwards, leading to a rebound of technology stocks and heavy trafficked hedge fund long investments. According to Morgan Stanley, the momentum reversal during the first two weeks of June was a 6-standard-deviation move, the highest since 2000. Despite that, hedge fund strategies’ exposure to higher-momentum sectors like technology remain relatively unchanged. Underperforming strategies were mainly Market Neutral funds, specifically those focusing on Emerging Markets and cyclical sectors like energy. The risk-on environment was detrimental to performance due to a strong rebound of short positions. The important plans announced to stimulate the economy could create tricky situations for short sellers. Nonetheless, Long Short Equity has come across as one of the winning strategies and best performers since the beginning of the COVID crisis. The liquidity of the underlying asset and the modularity of their net exposure allowed them to decrease risk at the beginning of the pandemic, generate alpha from short positions and progressively shift capital to businesses and thematics that would benefit from the crisis. Long Short Equity strategies are, in our opinion, of interest when navigating the current market environment, since they can modulate their risk appetite and generate returns from their long and short positions across a very wide range of investment themes. Good stock-pickers will be able to select winners and losers.

Global Macro

Performances were relatively dispersed for Global Macro funds. Discretionary strategies generally outperformed systematic investment programmes. Discretionary managers were able to benefit from selective directional trades. The best performers included funds that benefited from long equity positions and long Emerging Market sovereign issues. Systematic strategies, which tend to be more diversified by nature, and which rely on observable data, are finding it more difficult to deal with market noise. Winning investments on equities and fixed income tended to be balanced by losses on currencies and commodities. Considering the high volatility levels and future uncertainty, fund managers are constantly reassessing current positions. The massive stimulus programmes announced by central banks and governments all around the world should help stabilize the market. However, until the current health crisis is contained and we learn to live with it, the outlook will be foggier. In this environment, we tend to favour discretionary opportunistic fund managers who can draw on their analytical skills and experience to generate profits from a few strong opportunities worldwide. The stabilisation of the market and increased visibility in macro-economic data should lead to better performances from systematic strategies, whose expected realized volatility levels are lower than those of more concentrated discretionary managers.

Quant strategies

2020 has not been an easy environment for Quantitative Strategies. Models had difficulties dealing with the violent and rapid increase in market volatility and asset correlations between the end of February and April. The extreme and prolonged volatility levels reached during March led to a significant deleveraging of quantitative strategies, generating poor performance and leading to more deleveraging. The implementation of the stock-shorting ban on some European countries helped accentuate the deleveraging effect because managers were unable to implement or adjust the optimal portfolios of long and short securities as defined by their model. Market participation by Quant funds is increasing but still limited, due to relatively high volatility levels as per recent market averages. The broad quantitative strategies universe had a wide performance dispersion. For Liquid Quantitative strategies with longer-term models, it was generally a difficult month. There was no material winning strategy to offset negative contributions from equity market-neutral strategies impacted by the strong momentum reversal.

Fixed Income Arbitrage

If Fixed Income Relative Value had one of its most spectacular months in history in March 2020, this highlighted the need to be invested in managers with strong set-ups (secured-term repo lines with high-quality counterparts and longstanding relationships). At the end of March, our managers took advantage of the dislocation within the US basis to post historical positive returns from what has been a once-in-a-decade opportunity. As we came close to the June expiry, basis positions were rolled down on the September expiry, which seems quite attractive, even though not as good as the opportunity set in March. Like other RV trades, spreads are wider than they were pre-crisis, and we reiterate our positive stance on the strategy, even if the potential implementation of Fed yield control could be a significant game-changer for interest-rate volatility.

Emerging markets

A strong month for hedge-fund strategies focusing on Emerging Markets, which strongly benefited from the risk-on environment. Diversified and Relative Value strategies tended to be outperformed by Discretionary directional managers, who did well with their conviction trades. The main performance drivers were credit long positions in sovereign issues in Puerto Rico, South Africa and Argentina, and receiving rates from Brazilian and Mexican issues. The macro outlook remains extremely foggy for Emerging Markets, however. Fundamental managers stress that, in a zero-rate world, Emerging Markets is the only alternative if you want to invest in yielding fixed income. Considering the fragility of fundamentals, managers usually adopt a very selective approach. Trades are mainly implemented by investments in fixed income, credit and currencies, where the fear-driven pricing-in of risk is creating massive dislocations and opportunities by ignoring the fundamentals specific to each region. The market is cyclical and, as such, current massive dislocations are the seeds of future investment opportunities at more interesting entry points. We remain cautious about the strategy because, on top of fundamental considerations, EM assets might suffer from outflows of capital chasing opportunities in DM High Yield, and from a lack of liquidity.

Risk arbitrage - Event-driven

It was a good month for Event Driven. Special Situations strategies outperformed, due to their higher-beta sensitivity and ability to secure a higher market-capture ratio in strong directional markets. Pure Merger Arbitrage funds were, on average, positive but lagged the broad Event Driven Index since they had less catching up to do. Although March 2020 was a traumatic event for many Merger Arbitrage managers, the best funds have recovered their losses and, Year-to-Date, are positive. The broad Event Driven index is down for the year as at the end of June: mid-single digits. Currently, deal-making has dropped to its lowest level in a decade, which is not completely surprising, considering the level of uncertainty. While companies in the United States are usually among the strongest generators of deals around the world, the situation is particularly acute there, since overall acquisitions in April collapsed 90% compared to the same period last year, while overall acquisitions dropped 50% over the same period. This type of activity is cyclical and, as such, the number of deals should again increase, as GDP growth remains low (companies will compete for growth), visibility is rising and financing remains widely available. In the meanwhile, it is important to remain selective in deal selection due to the increased risk of deal failure.

Distressed

Distressed opportunities have finally arrived but not as we anticipated. Instead of reaching the end of the credit cycle progressively, the coma-induced world economy forced businesses into a high-speed crash against the wall. The question is therefore not about whether there will be distressed opportunities, but about how many. We hope that the monetary and fiscal stimulus plans being put together will be effective and limit the damage to our economies. However, it is a fact that they will not be able to save every business in the world. From the discussions we held with experienced managers, we gathered that credit was being sold off with aggressive quotes not only for fundamental reasons but also due to a lack of liquidity. Distressed managers are not rushing to dive right in. Assets being sold require deep fundamental analysis to be bid at the right price. Most managers have segmented this market dynamic into three phases. They started by buying discounted Investment Grade securities, trading them dynamically and selling them relatively quickly as liquidity-spread-widening started to close. They then initiated a more selective phase of buying fallen angels and selective high-yield securities. The third and final phase is currently ongoing, as more and more companies file for bankruptcy. According to Epiq, a legal services group, bankruptcy filings in the US are running at their highest pace since 2013. Moody’s and S&P projected default rates are, respectively, 13.3% and 12.5%. During the last three recessions, irrespective of the duration and level of these, default rates always peaked at around 10%. This time, however, the size of the economic shock is much bigger than anything we have ever met. It is therefore probable that many credit assets will still correct to adjust to the severity of the crisis.

Long short credit & High Yield

Credit spreads for Investment Grade and High Yield markets reached extreme levels unseen since the crisis of 2008. The market was also highly affected by the lack of liquidity, prompting the ECB and the Fed to step up their IG debt-purchasing programmes. The Fed also decided to include High Yield in its buying programmes to smooth the high amount of Investment Grade fallen angels downgraded to High Yield. Rating agencies forecasted that the amount of fallen-angel debt could reach $700 billion in the US, probably too big to be absorbed by the HY market smoothly. Investment Grade and short-term High Yield issue spreads reacted very quickly to liquidity injections, especially in the US. According to the managers we track, while this move to higher-quality issues was widely expected, there are still many opportunities not only in High Yield but also in the cross-asset relative value trades (long bond vs short equity) and intra-asset RV trades (long bonds and long protection) generated by market dislocations. Contrary to 4Q 2018, opportunities offered in credit will take longer to be arbitraged, leaving time for investors to review their allocations.